Pyrolysis—thermal decomposition in the absence of oxygen—has emerged as a cornerstone of circular economy strategies, transforming waste materials (plastics, tyres, oil sludge) into valuable fuels, chemicals, and carbon products. Yet, a persistent adversary haunts this process: coking. Coking— the formation of solid, carbonaceous deposits (char, tar, or coke)—plagues reactors, fouls catalysts, and cripples efficiency across all feedstocks. This article explores why coking is an inevitable byproduct of pyrolysis, dissects its mechanisms in plastics, tyres, and oil sludge, and evaluates cutting-edge solutions to mitigate its impact.

Why All Pyrolysis Processes Face Coking: The Fundamental Chemistry

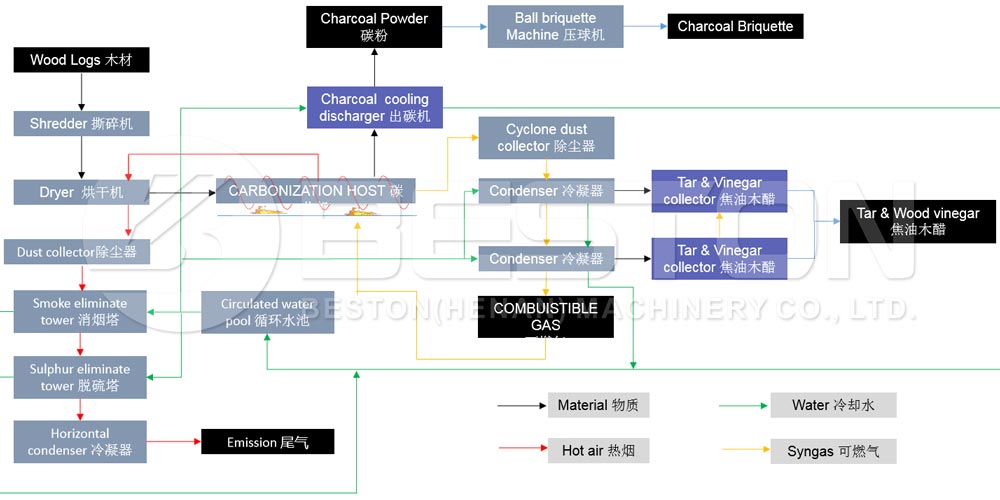

Pyrolysis involves breaking complex organic molecules into simpler ones via heat. For carbon-rich materials (all containing C-H bonds), this creates a spectrum of products: gases (methane, ethylene), liquids (bio-oils, syngas), and solids (char/coke). Coking arises from two pathways:

- Secondary Reactions: Fragile intermediates (e.g., free radicals, olefins) recombine into heavy aromatics or polycyclic aromatic hydrocarbons (PAHs), which polymerize into coke.

- Thermal Stability: High temperatures (>400°C) drive excessive cracking, forming carbon-rich residues.

All feedstocks—plastics, tyres, and oil sludge—share these chemical vulnerabilities. Their distinct compositions (below) dictate coking severity, not its absence.

Coking in Plastics Pyrolysis

- Feedstock Chemistry: Plastics (e.g., polyethylene [PE], polypropylene [PP], polystyrene [PS]) are long-chain hydrocarbons. Pyrolysis breaks chains into shorter alkanes/alkenes, but:

- Crosslinking: Unsaturated molecules (e.g., from PS) form stable aromatic structures.

- Additives: Fillers (talc), flame retardants (bromides), and plasticizers promote carbon deposition.

- Case Study: PE pyrolysis at 500°C yields 10–15% char (Zhang et al., 2024). PS, with benzene rings, produces 20–25% coke (Singh et al., 2023).

- Impact: Fouling in fluidized-bed reactors reduces heat transfer; catalyst deactivation (e.g., zeolites) lowers oil yield by 30–40% (Alvarez et al., 2022).

Click for plastic pyrolysis plant details.

Coking in Tyre Pyrolysis

- Feedstock Complexity: Tyres blend natural/synthetic rubber (polyisoprene, styrene-butadiene), sulfur (crosslinking), carbon black (20–30%), and metal (steel belts). Pyrolysis challenges:

- Sulfur Chemistry: Sulfur forms H₂S (corrosive) and thiophenic compounds, accelerating coke formation.

- Carbon Black: Inert filler acts as a nucleation site for coke deposition.

- Additives: Zinc oxide (vulcanization) and antioxidants create metal oxides that catalyze unwanted reactions

- Data: Tyre pyrolysis (450–550°C) yields 15–25% char (Sulfur content > 2%) (Wang et al., 2025). Coke deposits in screw reactors increase torque by 50% within 2 hours (Liu et al., 2024).

Click for tyre pyrolysis plant details.

Coking in Oil Sludge Pyrolysis

- Feedstock Heterogeneity: Oil sludge—industrial waste from refineries—contains:

- Heavy Hydrocarbons: Asphaltenes (high molecular weight, aromaticity).

- Contaminants: Metals (Ni, V), salts, and water.

Click for oil sludge thermal desorption unit details.

Coking Drivers:

- Asphaltene Instability: Thermally unstable asphaltenes precipitate as coke (40–60% yield).

- Metal Catalysis: Ni/V act as dehydrogenation catalysts, promoting coke formation.

- Water-Gas Reactions: Steam (from moisture) reacts with carbon, forming syngas, but excess steam accelerates char deposition (Chen et al., 2025).

- Case: In a pilot-scale reactor, oil sludge (80% TPH) produces 35% coke at 550°C (Zhao et al., 2023)—the highest among the three feedstocks.

Universal Impacts of Coking

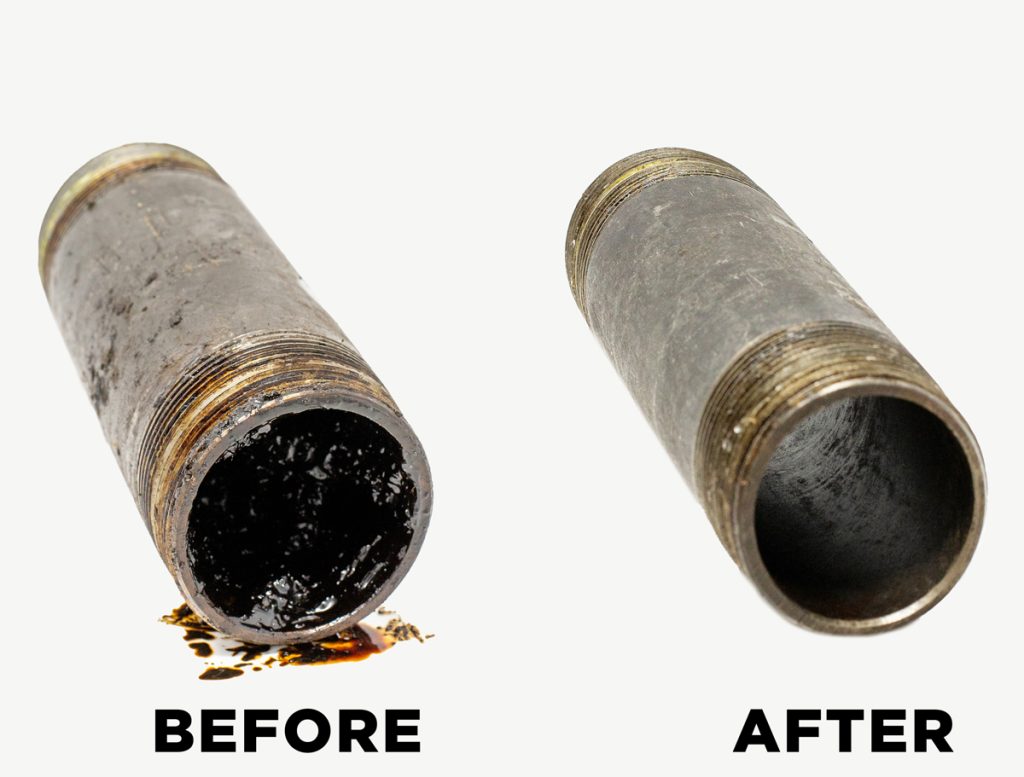

- Operational Downtime: Frequent reactor cleaning (every 50–100 hours) halts production.

- Energy Penalty: Coke deposition increases heat loss (15–20% higher energy consumption).

- Product Quality: Coke in bio-oil reduces calorific value (e.g., tyre oil: 35 MJ/kg vs. 42 MJ/kg for clean oil).

- Safety Risks: Coke buildup in pipelines risks blockages and explosions.

Mitigation Strategies: Tailored Solutions for a Universal Problem

1. Catalytic Pyrolysis

- Plastics: Zeolites (HZSM-5) reduce coke by 50% via controlled cracking (Liu et al., 2024).

- Tyres: Nickel-based catalysts (Ni/Al₂O₃) hydrogenate sulfur compounds, minimizing coke (Wang et al., 2025).

- Oil Sludge: Dolomite (CaMg(CO₃)₂) adsorbs metals, inhibiting coke nucleation (Zhao et al., 2023).

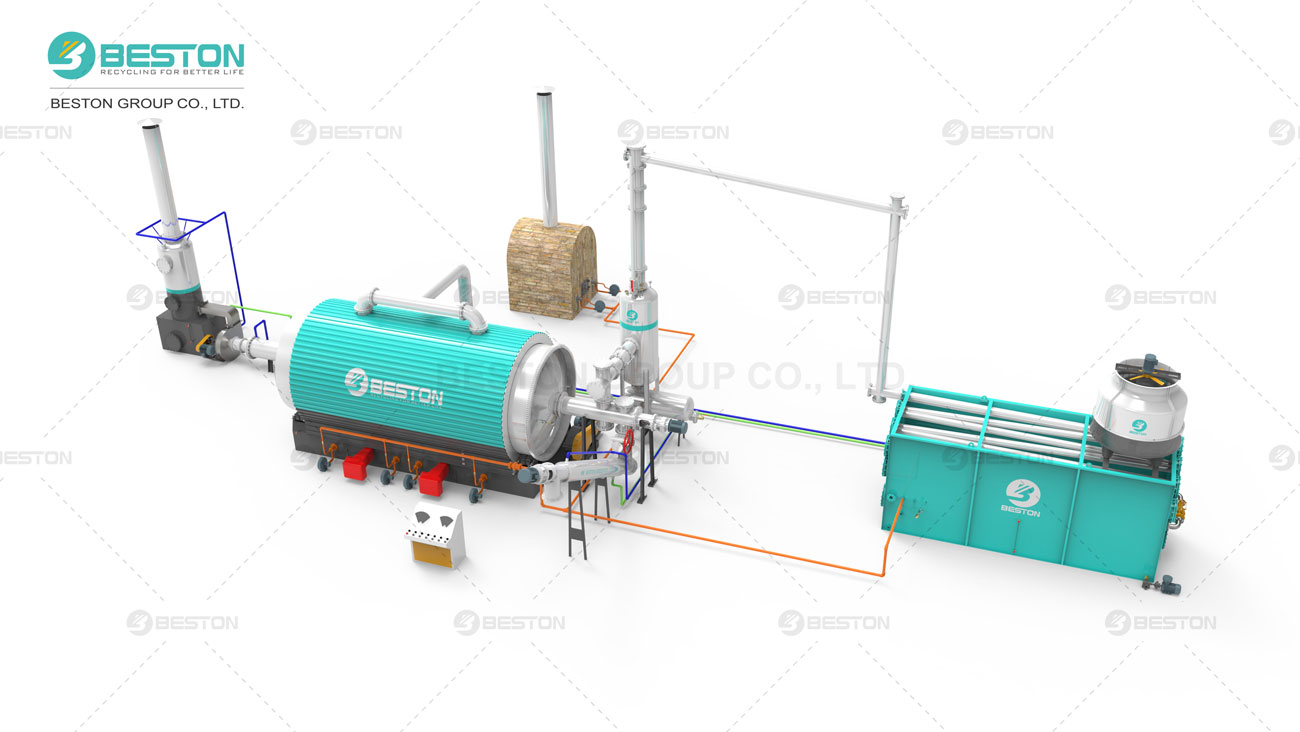

2. Process Optimization

- Temperature Control: Lower temps (400–450°C) for plastics/tyres; rapid heating (100°C/s) to bypass coke-forming intermediates.

- Reactor Design: Circulating fluidized beds (CFBs) reduce residence time (avoiding secondary reactions).

- Hydrogenation: Co-feeding H₂ (5–10%) saturates unsaturated molecules (e.g., in tyre pyrolysis, coke ↓ 30%).

3. Feedstock Pretreatment

- Plastics: Dewaxing (remove paraffins) and additive removal (via solvent washing).

- Tyres: Desulfurization (microwave pretreatment) and steel/carbon black separation.

- Oil Sludge: Dewatering (reduce moisture-induced char) and solvent extraction (remove asphaltenes).

4. Emerging Technologies

- Plasma Pyrolysis: High-energy plasmas (10,000°C) atomize feedstocks, preventing coke (pilot trials in 2025 show 5% coke).

- Biochar Additives: Co-pyrolysis with biochar (10% wt.) adsorbs intermediates (plastics: coke ↓ 25%) (Zhang et al., 2024).

Conclusion: Coking as a Catalyst for Innovation

Coking is not a flaw in pyrolysis—it is an inherent consequence of breaking and rearranging carbon bonds. Yet, this challenge has spurred innovation: smarter catalysts, advanced reactors, and circular pretreatment strategies. For plastics, tyres, and oil sludge, the path forward lies in tailored solutions within a universal framework: understanding feedstock chemistry, inhibiting coke nucleation, and transforming residues into assets (e.g., high-value carbon blacks from tyre coke). As the global pyrolysis market surpasses $20 billion by 2030 (Grand View Research), mastering coking is not optional—it is the key to unlocking a sustainable, waste-free future. More pyrolysis details in Beston Group.